MIT Living Wage Calculator: Why Higher Wages Help Everybody

-

-

slice.mit.edu

- 65

Filed Under

Recommended

Update July 2014: Professor Glasmeier reports that Ikea is now using the calculator to set their US wages.

Certainly this tool, with county-by-county statistics, provides data relevant to current discussions on raising the federal minimum wage. And its creator, Professor Amy Glasmeier, offers insights on how to transform America’s unemployment and underemployment problems into a solution that can help individuals and families as well as national productivity.

Glasmeier, professor of economic geography and regional planning, first developed the calculator in 2004 during a study of why some geographical areas that emerge from poverty, return to it in a few years. The difference between communities that returned to poverty—or not—was the rate of people participating in the labor market, she says. And a key reason people leave the labor market is because they can’t earn enough money in the traditional workforce to survive.

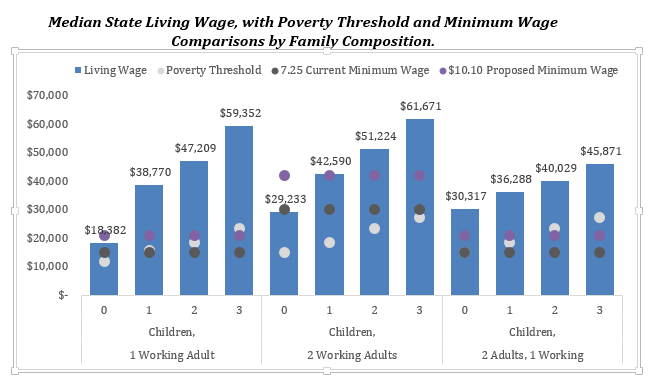

The MIT Living Wage Calculator lets you figure out how much is “enough” to live in your county by comparing the living wage—based on the barebones cost of housing, food, transportation, and child and health care—against the poverty wage and the minimum wage.

This is not a middle class lifestyle—the living wage does not include any savings and only one set of clothing for either hot and cold weather, not both. Surviving on the living wage is tough, she says, and it’s nearly impossible to live on the current federal minimum wage, $7.25. In comparison, the living wage for a family including one adult and one child in the state of Massachusetts is $24.84; for Mississippi, it’s $16.88. Check the living wage in your area.

So what has spurred public interest in raising the federal minimum wage to $10.10 now?

“We are seeing this cascading of human stories that are quite tragic, and everybody, even in the most sophisticated occupations like finance and health care, know someone who has lost their job or has had to move down in the labor market and is working for less than their skills are worth,” Glasmeier says. In addition, many parents see that their young college-educated children are under or unemployed, and employers see that their minimum wage employees often work a second job to cover basic living expenses.

Glasmeier says the argument that a higher minimum wage would reduce employment is questionable. Research shows that many employers prefer not to cut employees, whom they have invested time and money in, when wages go up. Rather, they may invest in productivity, so their returns go up. So raising wages plus public sector employment can be good investments, she says.

“When we began with the minimum wage, the argument was made that you were under utilizing human resources if you did not employ people and pay them a wage they could live on,” she says. “If, as a nation, we have millions of people out of work or under employed, then we are not using our assets wisely. If people are unable to achieve their maximum potential, that is also a drag on the economy.”

To paraphrase Henry Ford, you have to pay people enough to buy the things they produce—but raising wages also boosted Ford’s bottom line by reducing employee attrition. So, at least in that example, raising wages really did help everybody.

Comments

George Chyz

Thu, 04/17/2014 6:04am

The working class is the largest market and spends the most money. If the income of this group is pushed up then each worker can spend more which creates more jobs and the economy grows. On the otherhand if the business owners take more of the available profit for themselves the economy shrinks and jobs are lost. Henry Ford understood this simple concept. A documentry entitled "Inequality For All" provides the facts to support this simple concept and convince the aristocratic idiots who are out of touch with the basic reality that businesses need customers. Obviously if people aren't making a living wage then they can't go shopping. It really is that simple. Furthermore, if the minimum wage from the prosperous 1970's was adjusted for inflation it would be $28 today. If we want to turn around this slugish economy we need to pay the working class much more. The truth is that the workers who go shopping are the real job creators. The owners are leaches who use the workers for personal enrichment. Their big egos trick them into believing they are reasonable for much more than they are. There are of course hard working owners who are reasonable for their business' prosperity. More often it's the workers especially in big companies.

iwin online

Thu, 02/27/2014 10:01am

$10.10 per day is a basic wage in my country.

Nancy DuVergne Smith

Mon, 02/24/2014 4:01pm

The publication of the Slice of MIT blog post, MIT Living Wage Calculator: Why Higher Wages Help Everybody, in February’s Tech Connection generated lots of reader interest and comments. We’ve asked the MIT faculty member interviewed for the post to shed a bit more light on some of the issues.

Response from Amy Glasmeier, MIT professor of economic geography and regional planning:

“This is a serious technical issue and many of the points raised are a potential outcome of an increase in the minimum wage. We can lose jobs, we can gain jobs in different locations, and the minimum wage increase can have a minimum effect depending on the conditions in the labor market."

“Many factors will influence what will happen in the short, medium and long run.

“Most readers would agree that an increase in the minimum wage would have a positive consequence for those earning minimum wage. From the perspective of the employer, an increase in the minimum wage (assuming they pay their workers at the minimum) would raise the cost of labor. Assuming no change in demand for that company's product, in the short run, the employer would try to make adjustments in his/her costs in any number of ways including adjustments to the wage bill, by cutting back on hours; but they can attempt to reduce other costs, such as finding cheaper inputs, retraining their workers to be more efficient and more productive, undertaking a plan to reduce size through attrition etc. In other words, there are more choices than just firing or laying off the minimum wage worker. It is not always the case that the first reaction will be to reduce the number of workers.

“As I sit in the seat of my hair stylist, I asked her the following question: if the minimum wage went up today and your salon employed a person to wash all the stylists' clients’ hair, would your salon fire the minimum wage hair washer? She said no, the minimum wage worker in her salon is there to increase the output of the high-value senior stylist by allowing her to turn over more clients over the course of the day.

“The simple fact is that labor market processes are complicated and workers are not just variable inputs that can be turned on and off at will. As the argument plays out about what will happen, we are seeing many different points of view.”

Ken Thompson

Fri, 02/21/2014 12:52pm

Maybe the minimum wage SHOULD BE a living wage. Why shouldn't people who do menial jobs be able to live on what they earn?

Jamie B

Fri, 02/21/2014 7:57pm

Current trends in this country are towards a distribution of wealth that excludes more and more people from basic necessities: affordable housing, healthy food, healthcare, higher education, and in many cases, even basic employment. With the recent recession and its terrible effects on tens-of-millions of families in mind, I think the data and analysis presented by Glasmeier should be regarded as a starting point for good conversation and constructive debate. We’ve got problems and MIT claims to educate problem solvers.

The data presented are straight-forward and compelling. The claim in this article that seems to be raising so many objections is the idea that raising minimum hourly wage from $7 to $10 might not result in a net increase in unemployment. If true, this is an important consideration for making policy decisions. The knee-jerk rejections given here are a bit extreme. For instance, a $7 to $10 increase is not the same as a $7 to $25 increase no one is arguing the effects would be the same in that case. Also, the clichéd references to burger-flipping and “reversion” to socialism, that ancient boogeyman of capitalism ideologues, really smack of categorizations that don’t help the problem-solving. I would like to see my countrymen prosper, and it seems that Glasmeier and her colleagues are working towards that end in their way by presenting facts and offering a bit of analysis and interpretation.

JIM

Fri, 02/21/2014 10:42am

Although your chart might be good as motivation for someone to set income goals, it still depends on the individual to actually earn that income. Simply setting minimum wage numbers does little but transfer wealth from the ones who earn more to the ones who earn less. This doesnt fix anything. If someone wants to earn more than $7.25 an hour, they cant expect to make that flipping burgers at McDonalds for the rest of their life !!! They will have to make their work be worth more- through learning new skills or picking a more advanced line of work. Government mandates simply retard this process and encourage people to not improve themselves.

John Dulcey

Thu, 02/20/2014 9:05pm

Can you explain why the CBO said 500,000 jobs will be lost?

Fred Anderson

Thu, 04/30/2015 5:31pm

Perhaps the explanation lies in the conditional: "employers do not tend to cut employees, whom they have invested time and money in . . . ."

I would suggest that the minimum wage employee is likely undifferentiated labor and hence easily replaced. So the employer has likely invested very little time and/or money in them.

Ken Thompson

Fri, 02/21/2014 12:46pm

It seems to me that minimum wage should mean living wage. I'm a business owner with employees in three states (MA, CO, FL), and every one of them is paid a living wage and still makes money for my business. My employees are my partners in prosperity.

George Chyz

Sun, 05/25/2014 3:52pm

Check out this recent article that references new studies that indicate higher minimum wages create jobs. http://wapo.st/1o7xU3M

George Chyz

Tue, 05/20/2014 3:01am

In the documentary, "Inequality for All" 100 years of data from 1914 to very recently is used to show how higher wages for workers results in overall improvements in the economy and higher employment. Workers are not like goods that are bought and sold because workers earn their wage by doing their job which has a beneficial effect and because they spend their wage which stimulates the economy. Other things that are bought don't spend the money that is used to purchase them. Needless to say human beings deserve to be treated with some reasonable amount of compassion which would include paying them a wage that enables them to live at least a simple life. I hope this point which goes beyond logic can be comprehended by those who rarely venture outside the subset of consciousness known as intellect.

MarkPClassOf84

Wed, 05/14/2014 11:43am

I'd also like to know how many existing jobs would disappear, or new jobs not be created, if government imposed a minimum wage greater than their market value.

George Chyz

Sun, 05/04/2014 5:24pm

Bank loans are not investments of existing money. When a bank makes a loan it creates new "check book money" using the following slight of hand. The bank makes two entries in its ledger, one in the asset column for the amount of the loan, the other entry goes into the liability column for the negative amount of the loan. These entries cancel each other out such that the bottom line remains the same. Next the asset entry is transferred to the borrower via check or bank transfer. At this point new check book money has been created. Today over 98 percent of the US money supply is this check book money. Less than 2 percent is Federal reserve notes and coins. On a global scale over 600 trillion imaginary check book money has been created! You see there actually is an infinite amount of check book money available. On the other hand it doesn't seem right for banks to charge interest on this huge amount of money. This is the largest Ponzi scheme ever!

George Chyz

Mon, 04/28/2014 2:38pm

The Fed sets the corporate reserve rate at zero percent making an infinite amount of money available to businesses. The loans are of course contingent on market size and competition. The market size is not increased by the rich getting richer it is increased by the workers having enough money to spend it on more than room and board. Today there are homeless workers! Investments are of value to the investor and his broker. They compete with business loans and are not needed to create businesses or a thriving economy.

George Chyz

Thu, 04/24/2014 2:01pm

Of course owners spend. My point is that there are about fifty workers for one owner (high paid executive). If the workers income level doesn't provide dispoable income the economy shinks. When workers have disposable income the economy grows. Rasing the minimum wage will push up workers wages giving more of them disposable income that they will spend iin mass. While the owners are more likely to invest additioal income outside the basic goods and services economy. This is why increases in workers wages are more effective economic stimulators than increases in income for the wealthy. A strong working class makes a strong first world nation. The US is heading toward a third world economy.

Dan Maserang

Thu, 02/20/2014 11:08pm

The minimum wage is NOT supposed to be a living wage. And if people can't live on the wages they can earn in MA, then they should consider moving to MS. This drives down labor supply in MA and should raise the wages without reverting to socialism. The purported investment in productivity, unless accompanied by increased demand must result in fewer workers required. I am offended and object very strongly to the unfounded opinions in this article being passed off as fact with MITs name behind it. I know Course XIV professors who would also strongly disagree. (Econ PhD)

Jason

Thu, 02/20/2014 10:05pm

"Glasmeier says the argument that a higher minimum wage would reduce employment is unfounded. Research shows that employers do not tend to cut employees, whom they have invested time and money in, when wages go up. Rather, they invest in productivity, so their returns go up."

Ridiculous. While we are at it, why don't we just throw microeconomics out the window. Let's make the minimum wage $25 an hour. That shouldn't reduce employment one bit. And how about the marginal addition of an employee, which is what Glasmeier, shockingly, doesn't address? You don't think a business owner would think twice about adding an employee if the marginal cost was higher than before? What kind of first-level thought do we have coming out of my alma mater today??

Fred Anderson

Thu, 04/30/2015 5:39pm

I think your attitude is correct ("partners") and your outcomes admirable. But I strongly suspect your making / selling a high value-added product with more skilled labor. I'd be very surprised if you could do this in, say, the kitty-litter business.

Gerry Brown

Wed, 01/14/2015 8:12am

Love your calculator... Do you have a world wide living wage calculator?

Thanks, Gerry

Gerry Brown

Wed, 01/14/2015 8:09am

ARE WE SHOOTING OURSELVES IN THE $ POCKETBOOK?

WORLD POVERTY AND DEFLATION CAN BE STOPPED WITH A 12 WORD LAW!

3.6 Billion People living in poverty (1/2 world population) want to work and support their families and be a contributing part of society. The other half want to stop seeing their wages and benefits decline which is called deflation. Unfortunately in 132 poor nations where there are no minimum wage laws or they are set below $1 dollar per hour, their citizens are helpless to increase their wages unilaterally!

We are shooting ourselves in our financial pocketbook by not bring this huge economic resource up to a productive and living wage level.

The root cause of these low wages is an economic fact of life that Multi-National Companies (MNC) will place their factories in which ever nations offers the lowest wages and fewest regulations. It they do not do this they will go out of business as other companies sell goods at a lower cost (Wall-Mart slogan – Always Lowest Prices). These (MNC) are just as much a victim as these poverty nations as half the people in world cannot afford to buy the goods produced in their own factories.

Solution: Only USA as largest importing nation can stop this “Race to Bottom” by passing a straight forward law that states it is…

"Illegal to import goods from 132 nations not requiring $1 dollar hour minimum wage."

Henry Ford changed the USA in 1914 by doubling wages from $2.50 per day to $5.00 and creating the middle class.

The question is, can we in 2015 increase wages from less than $2.50 a day (United Nations definition of world poverty that covers 3.6 billion people) up to $8.00 and give ½ OF WORLD’S POPULATION a living wage for first time?

The world’s economy will get a $7,000,000,000 trillion dollar instant shot in the arm as it instantly produce 3.6 billion more customers and stop deflation for other 3.6 billion people.

Please pass this on to your Senator and Representative and ask them to pass the 12 word law!

More information is available on web at

http://www.worldpovertyupordown.org/

MarkPClassOf84

Mon, 05/26/2014 5:18pm

Correlation is not causation; there are many differences between metro areas and between states other then the minimum wages. "the state with the highest percentage of annual job growth was Washington — the state with the highest minimum wage in the nation, $9.32 an hour. The metropolitan area with the highest percentage of annual job growth was San Francisco — the city with the highest minimum wage in the nation, at $10.74."

MarkPClassOf84

Mon, 05/05/2014 8:47pm

Wrong - the borrower acquires a counterbalancing liability along with the asset. If there's any sleight-of-hand money in your post, it's those Federal reserve notes and coins that you imply are non-imaginary: what actual value backs them?

CertifiedInter…

Mon, 05/05/2014 8:40pm

Congratulations: you are both wrong and crazy.

MarkPClassOf84

Wed, 04/30/2014 4:57pm

You have an interesting definition of "investment" - on my planet, a business loan IS an investment. I'm glad to learn we agree that business loans create businesses and a thriving economy.

MarkPClassOf84

Fri, 04/25/2014 10:04am

So investment is of no benefit to the economy?

MarkPClassOf84

Thu, 04/17/2014 1:02pm

"If the income of this group is pushed up then each worker can spend more" - whereas owners burn their money? "if the business owners take more of the available profit for themselves" - that's a false dichotomy; since most businesses have a profit margin of a few percent, most of any wage increase is by necessity passed along to the consumer.

Darryl

Thu, 04/17/2014 12:19pm

Just the mimimim wage $100 per hour!. All the leeches moneys flood the economy!!1! Gorge your a jenus.

John Dulcey

Fri, 02/28/2014 1:50pm

The last comment was that "$10.10 is the basic wage in my country" but the writer did not give his or her country.

MarkPClassOf84

Sat, 02/22/2014 7:02pm

Even if it's true that raising the minimum wage wouldn't lead to firings, that doesn't imply that unemployment wouldn't rise, since the labor pool is continually growing.

MarkPClassOf84

Fri, 05/01/2015 1:57pm

Stop making sense.

Dan Maserang

Mon, 05/26/2014 2:29pm

"...this point which goes beyond logic can be comprehended by those who rarely venture outside the subset of consciousness known as intellect."

Have you ever had P&L responsibility? Have you ever managed a group of employees in an industry subject to intensely competitive market forces? Have you ever faced someone you had to lay-off because of increasing costs or decreasing demand? That is not "intellect", that is brass tacks, real world, cold, hard, brutal, survival. Contrary to your attempted insult, it is you, and all your whimsical commentary, who seem to have no apparent idea of what economics facts are.

Adam Delton

Tue, 02/25/2014 2:48am

I'm still compelled by the argument that increasing minimum wage will cause the employer to hire less, leading to increased difficulty for the unemployed to find employment. It seems by this logic that already employed minimum-wage workers would benefit, but those unemployed would suffer further.

MarkPClassOf84

Mon, 02/24/2014 5:45pm

"finding cheaper inputs, retraining their workers to be more efficient and more productive" - why wouldn't the employer have already done those things? "undertaking a plan to reduce size through attrition+ - which brings us back to the point already made in the comments: with an ever growing labor force, a new hiring that doesn't happen due to a higher minimum wage will increase unemployment.

MarkPClassOf84

Fri, 02/21/2014 11:52am

"Simply setting minimum wage numbers does little but transfer wealth from the ones who earn more to the ones who earn less." I think it's even worse than that - I think it primarily transfers wealth from the ones who consequently can't get jobs to the ones who manage to keep theirs.

George Chyz

Thu, 05/29/2014 3:14pm

Dan the us policy of allowing free trade without tariffs is destructive to our manufacturing industries. There is no way to compete with places where a living wage is $40 per month.This trade policy is an important factor in the decline of our quality of life. The WTO is not interested in humanity or the natural environment, rather it is guided by the global elite who are arrogant power mongers.

Mark correlation supports the possibility of causation and more importantly it strongly suggests that the opposite effect is unlikely to be true. In western Europe higher wages provide a high quality of living for nearly everyone. The USA may be the global military leader but we are begining to resemble the third world economically. Rasing the minimum wage and introducing tariffs would create prosparity for Americans without destroying all our manufacturing and farming industries which are the backbone of any strong nation. There is of course much that needs to change in the farming industry to improve the food quality but that's another subject.

Chris

Wed, 04/23/2014 2:00am

Actually, when the minimum wage was created, FDR stated that the minimum wage was in fact supposed to be a living wage.

George Chyz

Fri, 05/23/2014 4:33pm

I would expect the effect of raising the minimum wage to be related to the current minimum compared to the cost of living. Another important factor is the ratio of top pay to bottom pay. My main point is that the minimum wage aught to be set so a person with a full time job can live a simple life. When the minimum drops too low to meet the cost of living and the top-level incomes rise far above a reasonable multiple, some where between 5 to 50 times the min., quality of living declins for too many people. If a few people are living like royalty while most people experience strife the distribution of money is out of wack. We need to raise the minimum wage to shift the distribution of money back to a more balanced arrangement to achieve a higher quality of living for most people. The USA is based on democratic principles. The majority aught to be able to have a reasonable quality of living. MIT has claimed that technology would improve our quality of living however our quality of living is in decline. Furthermore, our life expectancy is in decline. We need to turn this back around. A more egalitarian distribution of money would be a good start. When workers are homeless they're under constant stress. As a world leader we need to address this money distribution problem. How can it be rectified without raising the minimum wage?

MarkPClassOf84

Sat, 05/17/2014 5:37pm

It's a fair question; quantifying 'what would have happened if' is inherently challenging. One could compare the job-number trends before and after the minimum wage change - but that assumes no other relevant changes. What is unquestionably true is that jobs do get created, that the rate of creation depends on and varies with causal factors - and that for many things bought and sold (which labor is), demand decreases as price increases.

More food for thought:

The Joint Economic Committee found that individual studies claiming no increase in unemployment from raising the minimum wage "are directly contrary to virtually every empirical study ever done on the minimum wage. These studies were exhaustively surveyed by the Minimum Wage Study Commission, which concluded that a 10% increase in the minimum wage reduced teenage employment by 1% to 3%." (http:// www.house.gov/jec/cost-gov/regs/minimum/50years.htm)

Harvard economics professor N. Gregory Mankiw concurs, saying "most research on the minimum wage finds that it reduces employment." (http://post.economics.harvard.edu/faculty/mankiw/columns/ bglobejune01.html)

And here's a study confirming that consensus:

Neumark, David, Mark Schweitzer, and William Wascher. 2004. "Minimum Wage Effects throughout the Wage Distribution." Journal of Human Resources 39(2): 425-450.

Abstract: This paper provides evidence on a wide set of margins along which labor markets can adjust in response to increases in the minimum wage, including wages, hours, employment, and ultimately labor income. Not surprisingly, the evidence indicates that low-wage workers are most strongly affected, while higher-wage workers are little affected. Workers who initially earn near the minimum wage experience wage gains. Nevertheless, their hours and employment decline, and the combined effect of these changes on earned income suggests adverse consequences, on net, for low-wage workers.

MarkPClassOf84

Sat, 02/22/2014 7:05pm

Why should people be forced to remain unemployed because the market value of their labor is less than the forcibly imposed minimum wage?

Rocco Pigneri

Wed, 05/14/2014 3:53pm

Mark, might you have an idea on how to calculate jobs not created? I hope this doesn't sound arrogant or angry over the forum, but I recall our government having a tough time defining how many jobs were saved by the Recovery Act in 2009, and this seems like an issue in the same vein. Might be interesting to see what an MIT alumni group could come up with :-).

Rocco Pigneri

Tue, 05/13/2014 4:38pm

I wish that the article went into more detail about underemployment. The majority of people I know who are paid minimum wage work at least one full-time and one part-time job in order to live in a safe neighborhood rather than working one job and living in an unsafe one. I would love to know how many jobs would open up in our economy if people involuntarily working two or three jobs were paid a living wage.

George Chyz

Wed, 05/07/2014 12:59pm

I hope the above argumemt clarifies how higher wages for workers creates jobs and stimulats the economy while greedy owners and executives drain the economy resulting in less jobs. Professor Glasmeier is correct, higher wages are good for everyone. Workers deserve more respect, they are the true heros doing everything that makes modern life possible.

George Chyz

Tue, 05/06/2014 12:00pm

Of course the borrower has the liability to pay back the loan. And fiat money has no real value. My point is that with a corporate Fed reserve rate of 0 percent an infinite amount of check book money is available to businesses. Thus investments are not needed.

George Chyz

Mon, 05/05/2014 2:11pm

Now that I have explained how banks make loans and pointed out that the corporate Fed reserve rate is 0 percent it follows that investors are not need for job creation. What is needed is a market that will provide customers. The working class is the largest portion of the population giving it the best potential. Furthermore the workers provide all the services and manufacture or grow all the goods that make civilization possible. The workers deserve a living wage and with out it the economy will crash just as it did in 1929.

Darryl

Thu, 04/17/2014 12:20pm

Sorry to George not Gorge my fault

Michael Kaericher

Sun, 03/09/2014 2:24pm

As already pointed out, there are so many problems with this article and with the professors response that it is risible. The real tragedy evinced by this article is the shallow thinking of someone apparently appointed "Professor" at MIT, and the equally shallow editing that allowed this thinking to be highlighted as a prime example of MIT leadership in economics. I find myself red-faced to admit that the institution I love has sunk to this.

Richard Leonetti

Thu, 02/27/2014 2:40pm

The minimum wage in Oregon is $9.10, not the $8.40 listed throughout.

Cynthia McInytre

Thu, 02/27/2014 10:40am

Very insightful article. Thanks!

George Reeves

Wed, 02/26/2014 12:11pm

Minimum wage law does not compel anyone to pay the wage. It simply outlaws jobs whose productive value is less than the minimum number. These are typically starter jobs and jobs done by disabled people who cannot better themselves by doing more. As a result our cities are dirtier, we pump our own gas, we no longer return bottles, and elevators lack a friendly and protective operator. People have been deprived of opportunity and the chance to be productive. Short term research will not show these negative effects because it took years to develop new labor saving machines and teach people to pump their own gas and run their own elevators. Once the labor saving changes are made they are permanent and the jobs cannot be recovered.

Larry C

Mon, 02/24/2014 10:09am

Professor Glasmeier's Living Wage table for Alabama's Madison County appears to have a glaring error in it. A 2-adult, 2-children family earning $32K a year couldn't possibly owe $5K in taxes. The Federal standard deduction for 2013 is $12.2K, and the personal exemption comes to $15.6K, so the resulting taxable income of around $4K would produce a tax of about $450, and the EIC would wipe that out. The state of Alabama isn't quite as generous (it's redder than Texas, after all), so the family would owe about $1100 to Montgomery.

Admittedly, this only reduces the "Livable Wage" by a couple of dollars per hour, but it does bring the credibility of the whole set of tables into question.