Nobel Laureate Proposes Retirement Strategies

-

-

slice.mit.edu

Filed Under

The increased longevity of the world’s population and the decreased prevalence of pension plans has made funding retirement a global challenge, says Nobel laureate and MIT Sloan professor Robert Merton PhD ’70. He proposes an approach to funding retirement that combines two existing financial institutions—reverse mortgages and annuities—to help middle-class retirees maintain their standard of living during retirement.

Merton, the 2016-17 S. Donald Sussman Fellow, explained how to do this in his second Sussman award lecture on Oct. 4.

Getting more from the assets people already have For those in the middle class, typically their home is their biggest asset. They need it to live in it during their retirement years, but after they die, it often is sold. The advantage for retirees is that they can reap the benefits while they are alive.

Basically, a reverse mortgage is a loan based on the value of a home. Unlike a typical mortgage, the loan-taker is not required to pay either interest nor principal during their lifetimes, though they still have to pay property taxes and homeowners insurance. In effect, they need not pay anything on the mortgage while alive.

Right now, the U.S. government is the only entity that offers reverse mortgages, but for them to be more effective, Merton believes they need to be moved into the private sector, where there are ways to ensure that the money to pay out reverse mortgages can always be accessible.

“The idea is to make reverse mortgages available to everyone,” Merton said.

Trade money they don’t need for money when they do need it Annuities are the second practice Merton thinks retirees should take better advantage of.

To buy an annuity, a person gives a company, often an insurance company, a lump sum. The company invests that money, and, in return, pays the person a fixed monthly income for life.

Merton included a caveat on annuities: “There are good annuities and bad annuities—I am talking about a well-designed version,” he said, referring to annuities with low fees from highly rated issuers that normally start paying recipients immediately. There are also deferred annuities—that do not start payments until a specified later date—that can provide longevity insurance to fit more tailored needs. Retirees need to do their homework on annuities, since there are many variations, and retirees are sometimes pressured into plans that aren’t best for them.

When chosen wisely, annuities can help alleviate the deep and pervasive uncertainty many retirees feel about potentially running out of money.

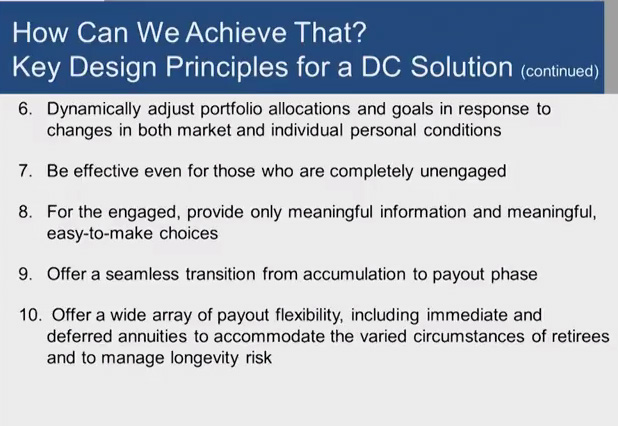

Putting it all together When annuities and reverse mortgages are used in conjunction, they can ensure regular income for retirees, functioning similarly to the defined benefit or pension plans that worked well in the past. Merton believes these are the only ways to improve retirement benefits without radically changing people’s saving behavior.

Since the concepts Merton outlined are based on universal financial principles, they can be applied globally with slight tweaks for specific countries, he says and they are already in practice in areas of the Netherlands, the UK, and elsewhere.

Merton recognizes that this is a big challenge, but it is one that can be met largely using market-proven technologies. Ultimately, he said, “the goal is to make this an available part of everyone’s retirement plan.”

Read full coverage of the talk on the MIT Sloan Newsroom.