Alums Demystify Financial Services with Unbiased Analytic Tools

-

-

slice.mit.edu

Filed Under

Recommended

When it comes to financial services, companies use everything from talking babies to Vikings to persuade people to use their products. You practically need a degree from MIT to decide on the best checking account or credit card rewards program. Which is exactly why the friends and family of Jake Gibson '04, who majored in math and finance at the Institute, sought him out for basic financial advice.

When it comes to financial services, companies use everything from talking babies to Vikings to persuade people to use their products. You practically need a degree from MIT to decide on the best checking account or credit card rewards program. Which is exactly why the friends and family of Jake Gibson '04, who majored in math and finance at the Institute, sought him out for basic financial advice."I realized that there was no trusted resource for them to find answers," Gibson says. So he left his job at JPMorgan Chase and cofounded San Francisco-based NerdWallet, a website that helps consumers make informed choices about their personal finances by creating free, simple tools and resources using a numbers-based, analytic approach. Users can do personalized searches based on their spending habits and receive unbiased results—the company's tagline is "We do the homework for you."

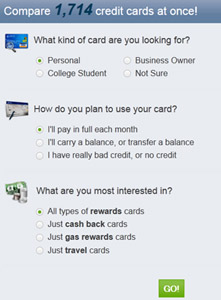

Here are just some of the comparison tools on the NerdWallet site:

- Credit cards based on the best balance-transfer offers, lowest interest rates, or most cash back

- Brokerage firms broken down by best data-analysis tools or research reports or lowest fees

- Checking accounts filtered by age and stage (teens, college students, seniors, or everyone else) as well as by type of financial institution (big, community, or Internet bank or credit union)

- Student loans based on estimated repayments

- Online shopping deals organized by cash back, points, or miles for purchases as well as those offering coupon codes and promos (there were nearly 46,000 deals and promos at press time, and you can sort by independent retailers and Etsy coupons as well)

Articles on the NerdWallet site provide advice on everything from investing to food stamps. NerdWallet Education offers a scholarship search and compares colleges based on highest employment rates and salaries for grads as well as schools with the most students volunteering or traveling after graduation. The education section of the site is completely free of ads and commercial referrals.

NerdWallet also provides advice on travel with a feature called TravelNerd. There's an online tool to compare various airline fees, and a newly launched smartphone app helps at the airport by recommending parking and transportation (including any taxi-sharing offers and phone numbers for car/shuttle services), amenities, and terminal maps.

The site has been getting great buzz this year, with its services and tools recommended by and mentioned in the New York Times, Los Angeles Times, Forbes, Time, Money, Huffington Post, and more.

NerdWallet is a labor of love for Gibson and his employees, many of whom took pay cuts and gave up successful corporate trajectories to help people and further the company's mission of transparency in the realms of financial, travel, and educational services.

So, has it been worth it?

Joseph Audette '05, VP of education and financial literacy, says it has. "My cousin just emailed me saying she used our site to know which bank was the best on her campus," he says. "You don’t get those emails when you are working at a hedge fund." A site like NerdWallet would have helped him with his own finances. "After MIT, I consolidated my loans privately and ended up paying much more than if I had consolidated using the federal system," he says. "I just didn’t know that was an option for me. That is why we created NerdWallet Education as a pro bono resource."

In the coming year, NerdWallet plans to release additional resources that focus on financial literacy and college affordability. It's also expanding nonprofit partnerships by working with the Bill and Melinda Gates Foundation on a new grant to help first-generation students and parents complete the FAFSA.